Maryland offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Maryland Clean Energy Rebate Program

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Maryland Government

Governor’s Office

100 State Circle

Annapolis, MD 21401

Phone: (410) 974-3901

Toll free: (800) 811-8336

[email protected]

Hours: M-F 8:00am – 5:00pm

BGE (Baltimore Gas and Electric Company)

Two Center Plaza, 110 West Fayette Street

Baltimore, MD 21201

Residential Customer Service

(800) 685-0123

Business Customer Service

(800) 265-6177

Fax: (443) 213-6017

Hours: M-F 7:00am – 7:00pm

Maryland Energy Administration

1800 Washington Blvd., Suite 755

Baltimore, MD 21230

(410) 537-4000

[email protected]

Hours: M-F 8:00am – 5:00pm

Baltimore/Washington Weather Bureau

43858 Weather Service Rd.

Sterling, VA 20166

(703) 996-2200

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Residential Clean Energy Rebate | $1,000 | Applies to primary residences with at least 1kw system capacity |

| Solar Sales Tax Exemption | 6% sales tax exemption | Applies to solar equipment |

| Solar Property Tax Exemption | Upgraded property value tax is exempt | Applies to residential property using solar energy |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Maryland Clean Energy Center

Energy 101

Solar for All Program

Biomass

CFI Grant

Clean Energy Summit

Clean Energy Policy

Contact

Maryland Department of the Environment

1800 Washington Blvd.

Baltimore, MD 21230

Monday-Friday

8am-5pm EST

Phone: (410) 537-3000

Email: [email protected]

For Environmental Emergencies:

1-866-MDE-GOTO

Maryland Solar Incentives Overview

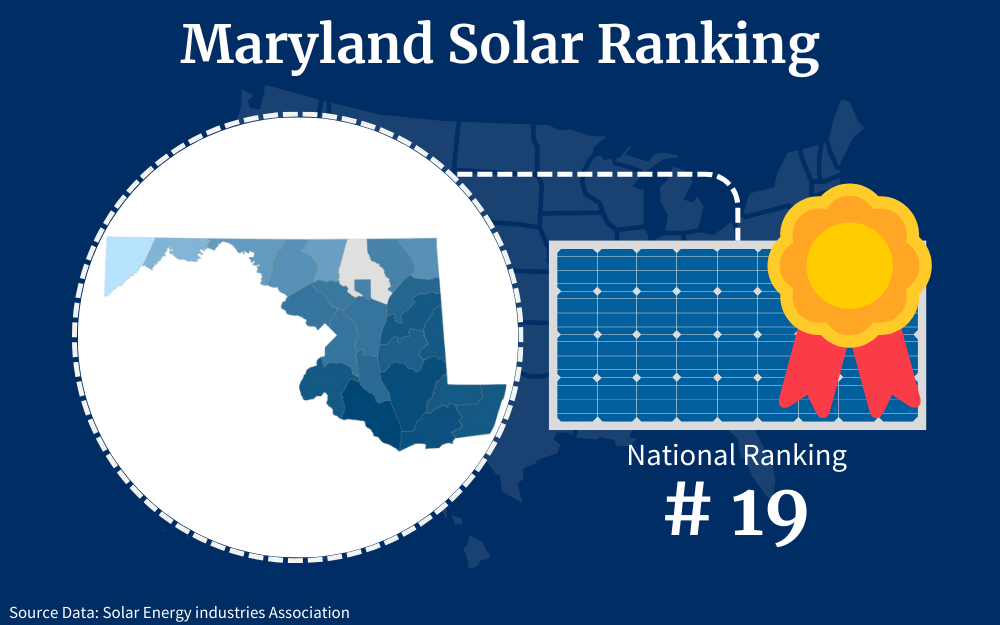

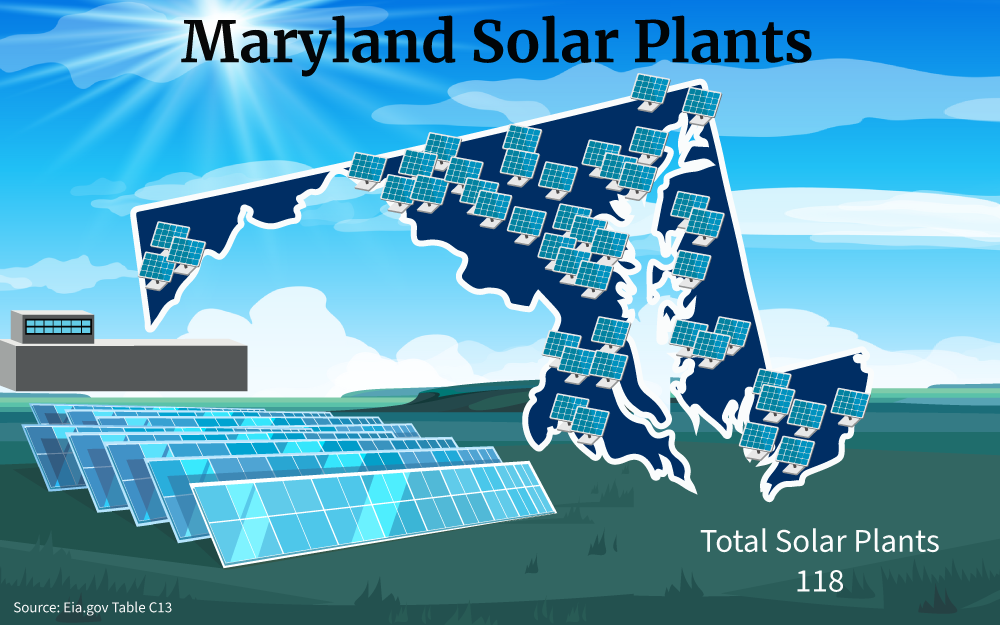

Ranking number 19 in solar adoption, Maryland offers many renewable energy programs, rebates and tax credits to help reduce the cost of energy reduction strategies across the state.

In fact, the steady support of the state government such as tax exemption on solar purchases and community solar programs contribute to its overall commitment towards cleaner energy sources.

But, home solar installation is also a benefit for residents in the state, reducing the cost of monthly electricity bills. And thanks to Maryland solar incentives, you can register for solar programs that provide government funds for your home’s green energy.

This complete guide outlines how you can take advantage of significant government rebates, credits and other state programs that lower home solar installation costs significantly.

How Do Solar Credits Work in Maryland?

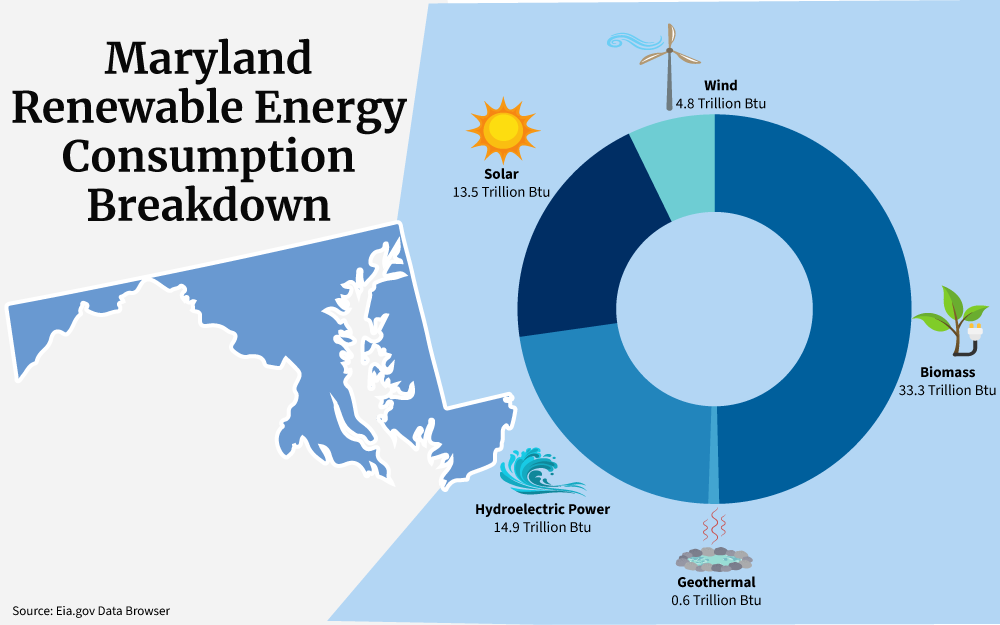

The proposal of Governor Larry Hogan through the Clean and Renewable Energy Standard also known as CARES, aims to transform how energy in Maryland is produced and utilized.1 Its main vision is to have available 100% clean electricity by 2040.

It is expected that this will further promote the popularity of using solar, wind, hydroelectric, and other emerging green technologies. Along with this, investments in renewable infrastructures will be on a steady rise, and this will also result in more people being able to enjoy its positive impact, not just on the environment, but on their finances as well.

The cost of transitioning to using solar energy in Maryland is higher than the average rate in the entire United States,1 but the state’s generous incentives mitigate it.

Maryland’s residents who decided to switch to solar power, are earning up to $800 yearly.2 This is through the Solar Renewable Energy Certificate (SREC) and some related tax savings.

Here are some of the well-known Maryland solar incentives available to residents:

| Maryland Solar Incentive | Location | Savings | Description | Frequency |

| Property tax credit for solar and geothermal devices | Harford, Baltimore, Prince George, Montgomery, and Anne Arundel County |

Credit is usually between 50 percent and 100 percent of the total cost of the solar or geothermal system | Some counties in Maryland offer tax credits on certain energy conservation systems and devices. | Single credit |

| Expedited solar permitting | Montgomery County | No savings upfront | Montgomery County makes sure that the Department of Permitting Services speeds up assessing solar system installation permits | Depends on the requirement |

| PACE Financing | Statewide | No savings upfront | PACE financing allows customers to finance energy improvements at a fair interest rate. The program also allows homeowners to repay their loans in the form of a surcharge on their property tax bill. | Approval once only |

The SREC program provides solar panel rebate Maryland to those who willingly install solar panels.

A specific amount of electricity that these solar panels generate in excess is then in layman’s terms sold to partner companies which is also distributed to others.

Aside from the SREC participants earning a steady income, this also ensures that there’s a steady flow of electricity throughout Maryland.

ITC Tax Credit Options

Below are the ITC Tax Credit Options that a Maryland homeowner who uses solar energy enjoys:3

- Inflation Reduction Act (IRA): This is an act made in 2022 and is considered the largest investment that the United States made for climate and energy. This mainly tackles the sources of domestic green power, including solar panels.21

- Solar Renewable Energy Credits (SRECs): This is considered the most enticing crediting option in using solar energy. This varies at the state level in the United States.

The cycle of earning from SREC starts from the generation of solar energy through solar panels, the generation of SREC depending on the megawatt-hour produced by the solar system for the home, selling of the generated SREC in the market such as to the electricity suppliers and utilities, generation of income for the solar system owners, and lastly is the compliance of all the involved parties to make SREC a successful one.22 - Solar Energy System Property Tax Exemption: This is not offered only in Maryland, but also by many states in the United States that actively encourage the installation of solar panels. Through this, if you are using a solar panel, you will enjoy the relief of payment of some property taxes since this also increases the value of the property when solar energy is attached to it.23

- Solar Panel System Sales Tax Exemption: Because solar energy equipment is not affordable, this exempts or reduces the amount of its cost. The government waives the sales tax on solar panels and associated solar kits to encourage more people to install and switch to solar energy utilization.

- Residential Clean Energy Rebate Program (R-CERP): This is an incentive program by Maryland that offers rebates to its homeowners who installed clean energy systems such as solar systems. Below is the table that shows the rebate levels10 depending on the installed clean energy technology and eligible system capacity range:

| Clean Energy Technology | Eligible System Capacity Range | Rebate Amount |

| Solar Photovoltaic (PV) | Minimum 1 kW-DC | $1,000 |

| Solar Shingles | Minimum 1 kW-DC | $1,000 |

| Solar Water Heating (SWH) | Minimum 10 sq. ft. | $500 |

| Geothermal | Minimum 1 ton | $3,000 |

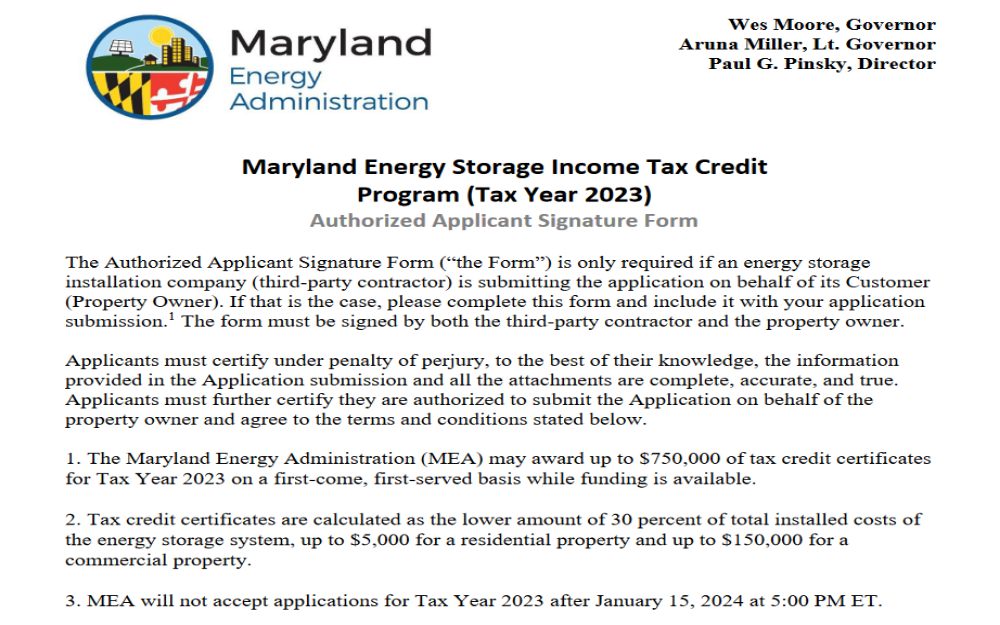

The awarding of tax credits and Maryland solar incentives is on a first-come, first-served basis. This means that whoever submits the form and completes the requirements early on during the fiscal year will have a better chance of having their system costs offset by the rebate.

Currently, the government of Maryland already announced that the tax credits for 2023 have been maxed out, and no longer accept new submissions as of August 1, 2023.11 A total of $750,00 has been exhausted for tax credits, and this translates to the success of the state’s campaign to urge its homeowners to switch to clean energy.

Below is the table summarizing the solar panel tax credit options in Maryland:

| Maryland Solar Incentive | Description |

| Solar Renewable Energy Credits (SRECs) | Earn SRECs for each MWh of solar electricity generated, which can be sold on the market for revenue. |

| Residential Clean Energy Grant Program | Grants for residential property owners to offset the upfront costs of solar panel installation. |

| Property Tax Credit | Reduces property tax burden associated with the increased property value due to a solar system. |

| Income Tax Credit | Provides a tax credit against state income taxes for a portion of the solar system installation costs. |

| Sales Tax Exemption | Exempts solar equipment purchases (e.g., panels, inverters) from state sales tax, reducing overall costs. |

| Community Solar Programs | Support for shared solar installations, enabling multiple participants to benefit from a single solar array. |

Can I Sell Power Back to the Grid?

A homeowner in Maryland can definitely sell power back to the grid through the help of Net Metering. This tool helps an owner to get credits with its calculated excess electricity generated through his or her installer solar panels.

With that excess, it goes back to the grid and can significantly have an effect with regard to the credits that can be obtained positively. 7

However, it is worth noting that the credits from Net Metering always expire every April each year.12 Based on data, most of the properties that have solar panels installed tend to generate a lot of electricity during summer.

With this, the excess generated electricity is then stored in the batteries. The electricity that is stored in the batteries is often used during winter when sunlight isn’t that strong thus generating electricity can be difficult.

The homeowner also has an option of putting the stored energy in the batteries back on the grid to get more credits if ever needed.

If in case the credits expire, the state will make sure that they will be returned at a rate that is fair to the average wholesale rate. The electricity tariff should have further information about this.

The electricity tariff of Maryland shows almost all the amounts involved when it comes to electricity. It shows the following information:

- Generation charges

- Transmission charges

- Distribution charges

- Supply charges

- Service fees

- Renewable energy charges (This is what you should look at when it comes to monitoring your solar equipment.)

- Taxes and surcharges

Solar ITC Forms for Maryland and Federal Tax Credits

As long as you are a homeowner in Maryland and managed to install home solar panels, you automatically qualify for the Federal Solar Investment Tax Credit or ITC.8 This can help you lessen the cost of solar panel installation by 30 percent.

It is true that earning credit can get a significant decrease on the owed federal taxes, but getting more credit than what one owes in taxes can have its remaining balance rollover which can be valid for 5 years.13

If you are planning to apply for ITC, it is important to fill out the file Internal Revenue Service (IRS) Form 5695 and the federal solar tax credit form.19 Aside from the spaces to fill out, this form also includes helpful guides and instructions on how to correctly fill it out along with the documents that must be submitted.

Here are the steps on filling out Form 5695:

Step 1. Collect all necessary documents such as invoices and receipts related to the purchase and installation of your solar energy system.

Step 2. Fill out IRS Form 5695, specifically focusing on lines that pertain to the Residential Energy Credits, which will help you calculate your tax credit amount.

Step 3. Once completed, attach Form 5695 to your federal tax return (Form 1040) before submitting it to the IRS.20 Make sure to also include any supporting documentation required.

Checking some related websites that can share the instructions much simpler can be a huge help, too.

If you are wondering what forms do I need for Maryland solar incentives and tax credits, below is the list of the government solar panel program documents as shared by the state of Maryland:

- TY 2023 Authorized Applicant Signature Form:14 This is a document associated with the Maryland Energy Storage Income Tax Credit Program. This form would be used to authorize an individual or entity to apply for the energy storage tax credit on your behalf for the tax year 2023 in the state of Maryland.

- TY23 FOA Energy Storage Final:15 This is a document issued by the Maryland government or relevant state agency to provide information about funding opportunities related to energy storage projects in the state of Maryland. These funding opportunities aim to incentivize and promote the development and deployment of energy storage technologies.

- TY 2023 Claiming Tax Credit Instructions16

- Tax Credit Example Calculations17

Installing Home Solar System: Steps

So, what do solar panels do? Why are solar panels becoming a trend not just in Maryland, but in other parts of the world?

Solar panels which are also known as photovoltaic (PV) panels or photovoltaic solar cells used to gather and store energy with the help of sunlight. It has multiple photovoltaic cells that absorb the photons coming from the sunlight which is then converted into electricity.

Below are the common steps taken when installing solar energy equipment in a home:4

- Site Evaluation: This is where the installer makes an assessment of your property’s suitability to have solar panels installed. Several factors will be considered such as the amount of sunlight it receives, the shading, roofing condition and design, and the space for solar panels.

- System Design Approval: After evaluating the site, the installer will now create a design based on the evaluation made. This includes the number of solar panels that can be installed, their placements, and other important components.

Before they are installed, the approval of the homeowner is required. - Permit Approval: Right before the installation, it is important that required permits are obtained from the state government. This makes sure that the solar panels to be installed comply with the state’s building codes and safety regulations.

- Installation: After obtaining the permits, the installer will start to install the solar energy equipment following the approved design. It may take a couple of days to weeks, depending on the size of the project.

- Final City Inspection: A city or state inspector will have to visit the property and make sure that the installed solar system complies with the approved design and is within the acceptable safety and building code requirements.

- Utility Connection: Once the inspection has been passed, it’s time to connect to the utility grid. This involves a meter that can track the energy that your solar system both consumes and generates.

This is crucial because every excess energy, it is sent to the solar grid where the homeowner can earn the credit.

How To Use a Solar Savings Calculator

Through the help of a residential solar power calculator, it can estimate the savings that a homeowner can earn after the successful installation of the solar panels.

Usually, companies that offer solar system installation offer this for free as part of their marketing strategy.5

- Gather Information: Collect your electricity usage data, including your monthly or annual electricity bill, and your location (zip code).

- Access the Solar Panel Calculator: Visit a reputable solar savings calculator website or use a solar calculator tool provided by a solar installer.

- Enter Your Location: Input your zip code or location to account for regional variations in solar irradiance and energy rates.

- Input Your Energy Usage: Enter your monthly or annual electricity consumption data (in kilowatt-hours or kWh).

- Examine Your Electricity Bill: Review your recent electricity bills to confirm your energy usage, rates, and any tiered pricing structures.

- Enter Solar System Details: Input information about your planned solar system, including its size (in kilowatts or kW) and estimated cost.

- Determine Financial Incentives: Include any available financial incentives, such as federal tax credits or state-specific incentives or rebates.

- Calculate Solar Savings: Run the calculator to generate estimates of your potential solar savings, including energy bill reductions.

- Review Payback Period and ROI: Examine the payback period, return on investment (ROI), and the total savings over the lifespan of solar panels (solar panel lifespan).

- Explore Financing Options: Consider various financing options, such as cash purchases, solar loans, or solar leases, and their impacts.

- Assess Environmental Benefits: Evaluate the environmental impact of your solar system, including greenhouse gas emissions reduction.

- Get a Cost Estimate from Installers: Contact local solar installers to obtain quotes based on your calculations and discuss system design and costs.

Based on the common solar savings calculator, below are the common inclusions in its calculation:6

- Roof

- Electricity Bill

- Current offers within the vicinity of the property

How To Choose Solar Panels in MD

There’s no doubt that installing solar system for home is not cheap, but in Maryland, investing in it is all worth it knowing that it has loads of incentives waiting for you to enjoy.

This also helps the state of Maryland to have a steady increase in the number of households that already have solar systems installed.

- Assess Your Energy Needs: Review your past electricity bills to determine your monthly and annual consumption. Then, know if you want to offset all or just a portion of your obtained energy from solar power.

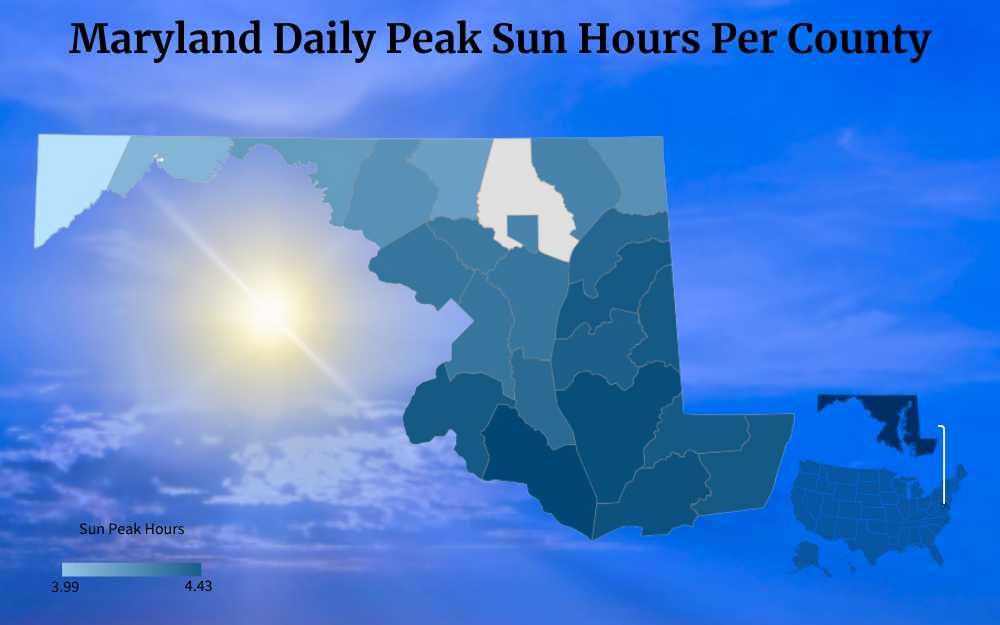

- Evaluate Your Location: Always consider the fact that different regions in Maryland also have varying amounts of sunlight received. The installation of the solar system on your roof must always face the sunlight to absorb more energy.

- Set a Budget: You have to make sure that you have enough budget for this project. You may also consider solar equipment leases.

- Research Solar Panel Types: There are several types of solar panels that vary depending on sturdiness, space, and power efficiency. It is also important to note what are solar panels made of as this may heavily affect the efficiency of the equipment.

- Review Panel Warranties: Always check the warranty of the solar system you are about to purchase. Those which have longer warranty can provide you better peace of mind.

- Compare Solar Installers: It’s best that you inquire about multiple solar installers in Maryland. Obtain multiple quotes, compare prices, etc.

- Aesthetics: While not that important, it is still best to consider how your property looks after the installation of solar equipment. Consider choosing among different frame colors and designs.

- Seek Recommendations and References: Do not be shy about asking your neighbors for recommendations. Research online as reviews may be posted there.

- Finalize Your Decision: Based on what you’ve researched, about time to choose the solar equipment brand along with the solar system installer you are about to hire.

- Sign the Contract: Always review and sign a contract. It’s not advisable to settle for verbal agreements.

- Monitor System Performance: For the first few months, closely monitor how your solar system works and constantly communicate with your hired installer.

According to Maryland’s data as of August 2023,9 a panel costs an average of $3.02/W in the state alone. When it comes to installation, the upfront cost ranges from $12,835 to $17,365.

The cost varies and with this, it is best that you compare the top solar installers in Maryland.

The posted reviews online and your neighbor’s recommendations are also considered very helpful ways to choose the best solar system installer.8 The provider that you’ll choose should be able to adapt to the ever-increasing demand for solar systems along with its reliability when it comes to after-sales services.

The incentive programs that Maryland implemented can be considered successful given the steady increase of people who switched and are planning to switch to clean energy.

Detailed information about these Maryland solar incentives is readily accessible and clearly outlined on the state’s official website.

Frequently Asked Questions About Maryland Solar Incentives

Is Going Solar in Maryland Worth It?

With the number of incentives that the state has for switching to clean energy, it’s a resounding “yes” to questions like are solar panels worth it in Maryland. While the cost of installing it appears to be expensive, the number of incentives can offset it significantly.

Does Maryland Offer Free Solar Panels?

There are no programs for free solar panels Maryland offers, but they offer promising credits to offset the cost of installing the solar system equipment by a significant amount. Aside from that, you may also enjoy lifetime savings from the state’s other solar credit programs.

Is Sunlight Reliable in Maryland for Solar Energy?

It is true that Maryland has seasonal variations throughout the year. Because of this, Maryland is always an ideal location if you are planning to switch to using solar energy in your household.

References

1MEA – Solar. (n.d.). Maryland Energy Administration. Retrieved September 7, 2023, from <https://energy.maryland.gov/pages/info/renewable/solar.aspx>

2Maryland Solar Incentives, Tax Credits And Rebates Of 2023. (2023, August 21). Forbes. Retrieved September 7, 2023, from <https://www.forbes.com/home-improvement/solar/maryland-solar-incentives/>

3Maryland Solar Incentives | MD Solar Tax Credit. (n.d.). Sunrun. Retrieved September 7, 2023, from <https://www.sunrun.com/solar-by-state/md/maryland-solar-incentives>

4Solar Panel Installation Process. (n.d.). Solar.com. Retrieved September 7, 2023, from <https://www.solar.com/learn/solar-panel-installation/>

5Solar Calculator:Calculate How Much Solar Will Cost. (n.d.). EcoWatch. Retrieved September 7, 2023, from <https://www.ecowatch.com/solar/calculator>

6Solar Calculator: Estimate 2023 Solar Savings. (n.d.). EnergySage. Retrieved September 7, 2023, from <https://www.energysage.com/solar/calculator/>

7Is Solar Worth It? Selling Power Back to the Grid. (n.d.). Inspire Clean Energy. Retrieved September 7, 2023, from <https://www.inspirecleanenergy.com/blog/clean-energy-101/is-solar-worth-it>

8Solar Panels in Maryland: Costs, Incentives and Top Installers. (2023, July 7). CNET. Retrieved September 7, 2023, from <https://www.cnet.com/home/energy-and-utilities/maryland-solar-panels/>

9Maryland Solar Panel Cost: Is Solar Worth It In 2023? (2023, March 15). EnergySage. Retrieved September 7, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/md/>

10MEA – Solar. (n.d.). – Clean Energy Grants Retrieved September 7, 2023, from <https://energy.maryland.gov/residential/Pages/incentives/CleanEnergyGrants.aspx>

11Maryland Energy Storage Income Tax Credit- Tax Year 2023. (n.d.). Maryland Energy Administration. Retrieved September 7, 2023, from <https://energy.maryland.gov/business/Pages/EnergyStorage.aspx>

12Chace, D., & Mitchell, C. (n.d.). GUIDE TO SOLAR. Maryland Energy Administration. Retrieved September 7, 2023, from <https://energy.maryland.gov/Reports/A%20Maryland%20Consumers%20Guide%20to%20Solar.pdf>

13Maryland Energy Administration. (2022, October 11). Maryland Energy Administration. Retrieved September 7, 2023, from <https://news.maryland.gov/mea/2022/10/11/federal-investment-tax-credit/>

14Maryland Energy Administration. Energy Storage (2022, October 11). Retrieved September 7, 2023, from <https://energy.maryland.gov/business/SiteAssets/Pages/EnergyStorage/TY%202023%20Authorized%20Applicant%20Signature%20Form.pdf>

15Funding Opportunity Announcement Maryland Energy Storage Income Tax Credit – Tax Year 2023. (n.d.). Maryland Energy Administration. Retrieved September 7, 2023, from <https://energy.maryland.gov/business/SiteAssets/Pages/EnergyStorage/TY23%20FOA%20Energy%20Storage%20Final.pdf>

16Maryland Energy Administration. Tax Credit Example. Retrieved September 7, 2023, from <https://energy.maryland.gov/business/SiteAssets/Pages/EnergyStorage/TY%202023%20Claiming%20Tax%20Credit%20Instructions.pdf>

17Maryland Energy Administration. Tax Credit Example Calculations. Retrieved September 7, 2023, from <https://energy.maryland.gov/business/SiteAssets/Pages/EnergyStorage/Tax%20Credit%20Example%20Calculations.pdf>

18Prints & Photographs Reading Room, Prints & Photographs Division. (n.d.). Library of Congress. Retrieved September 14, 2023, from <http://hdl.loc.gov/loc.pnp/pp.print>

19Internal Revenue Service. (2023). Form 5695. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

20Internal Revenue Service. (2023). Form 1040. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>

21The White House. (2023). Inflation Reduction Act Guidebook. The White House. Retrieved September 15,2023, from <https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/>

22Solar Energy Industries Association. (2023). What’s a solar renewable energy credit (SREC). SEIA. Retrieved September 15, 2023 from <https://www.seia.org/initiatives/whats-solar-renewable-energy-credit-srec>

23Solar Energy Industries Association. (2023). 25 states Offer sales tax exemptions for solar energy. SEIA. Retrieved September 15, 2023, from <https://www.seia.org/initiatives/solar-tax-exemptions>